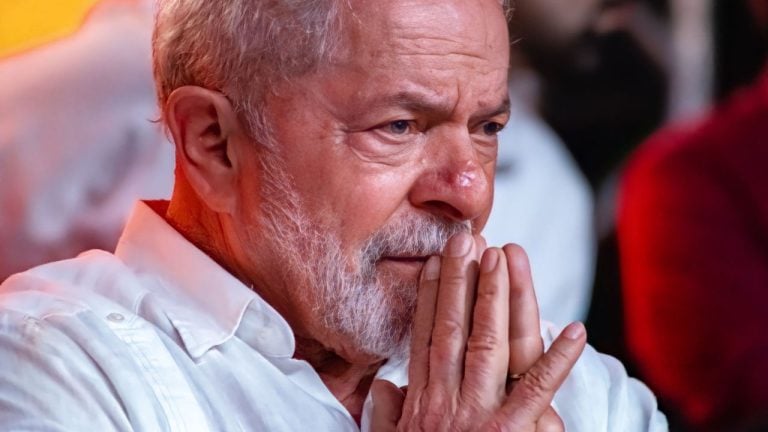

The government of Brazil views the development bank established by the BRICS bloc as an alternative to traditional financial institutions, the country’s head of state told African diplomats. President Lula da Silva also vowed that the bank will improve cooperation with its African counterpart.

Brazil Wants the New Development Bank Under BRICS to Strengthen as Financing Instrument

Authorities in Brasilia consider the New Development Bank (NDB), created by the BRICS nations (Brazil, Russia, India, China, and South Africa), as a promising alternative to traditional financial institutions, Brazilian President Luiz Inacio Lula da Silva was quoted as saying by the Tass news agency.

Lula made the statement during a meeting with ambassadors from African countries. “We want the BRICS bank to strengthen as an alternative instrument for financing, and we will reinforce our cooperation with the African Development Bank,” he emphasized.

Current international financial and banking institutions ignore the needs of developing nations and are not suitable for them, because many of those countries are being “strangled by overwhelming debt burdens,” he elaborated on Thursday.

The BRICS countries established the NDB, formerly called the BRICS Development Bank, after signing an agreement in Fortaleza, Brazil, in the summer of 2014, when Dilma Rousseff was President of Brazil. In March 2023, she was elected president of the bank.

The BRICS’ development bank funds infrastructure and sustainable development projects in the bloc’s member states and developing countries. In 2021, the NDB admitted Bangladesh, Egypt, the United Arab Emirates, and Uruguay to the scope of its activities.

Nearly 100 projects for almost $33 billion have been approved by the bank since its launch in areas such as transport, water supply, clean energy, digital and social infrastructure, and urban construction, the report noted.

In April of this year, the Shanghai-headquartered bank announced it has issued its first “green” bonds in U.S. dollars in the amount of $1.25 billion. The proceeds from the placement will be used to finance or refinance eligible “green” projects in participating nations.

Do you think the role of the NDB will continue to expand in the coming years? Share your thoughts on subject in the comments section below.

from Bitcoin News https://ift.tt/OlivcHr

via NEWS BTC

Post a Comment